Rare Coin Investing: A Guide for Beginners

Rare Coin Investing: A Guide for Beginners

The allure of holding a piece of history in your hands is one of the many reasons people flock to the world of rare coins. Not only can these coins provide a tangible connection to the past, but they also offer an opportunity to diversify investment portfolios. With the right approach, rare coins can yield long-term financial gains while serving as a fascinating hobby.

When delving into the realm of rare coin investing, it's crucial to recognize that these coins differ from traditional investments like stocks or bonds. Their value doesn't necessarily sway with the general market trends. Instead, several factors influence their worth, with demand and rarity at the forefront. As a result, a coin's scarcity can significantly amplify its value, often leading to substantial returns for the investor.

Despite the potential for profit, it's important to understand that the rare coin market is subject to fluctuations. These shifts in demand can mirror the overall volatility experienced in broader financial markets. That said, coins are generally seen as a more stable asset class, particularly when compared to the highly volatile nature of the stock market.

It's noteworthy that rare coins have outperformed their intrinsic metal values historically. Some elite coins have seen staggering appreciation rates, as evidenced by market analyses from newsletters such as Finest Known. However, it's imperative to view rare coin investment as a complement to a diversified portfolio rather than the sole investment avenue.

The landscape of the rare coin market has undergone considerable change, especially with the advent of third-party grading services in the 1980s. These organizations have brought a significant level of trust and standardization to coin grading, thus mitigating some investment risks. Furthermore, the rise of the internet has democratized access to information, empowering investors to make more educated decisions.

For those new to rare coin investment, finding a mentor can be invaluable. This person could be an experienced collector or a coin dealer with a wealth of knowledge to share. Engaging with coin-centric resources such as shows, literature, clubs, and online communities can help investors build their proficiency in this niche field.

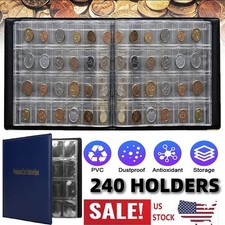

Diversifying your coin portfolio is just as crucial as diversifying other types of investments. Mixing U.S. Coins, gold bullion coins, and classic specimens such as the double eagle can enhance your collection's resilience. Keep in mind that aiming for long-term gains rather than rapid profits is typically a safer and more sustainable strategy.

Awareness of market volatility is essential, as is the ability to avoid speculative bubbles. Prudent research and a clear understanding of each coin's unique value will serve as your navigation tools through this potentially tumultuous market.

To truly engage with rare coin investing, it is necessary to delve into the nuance and complexity that each coin offers. Here are some core concepts and strategies to assist both novice and experienced collectors in navigating the rare coin market:

Factors Influencing Coin Value

Understanding how coins are valued is key to making informed decisions. Rarity, condition, historical significance, and collector demand are integral components of a coin's worth. Familiarizing yourself with these elements will provide a solid foundation for assessing a coin's potential value.

The Role of Numismatists

Numismatists, or coin enthusiasts who span collectors, scholars, and dealers, bring a wealth of knowledge and passion to the field. Engaging with organizations like the American Numismatic Association can offer educational resources and connections with fellow numismatists.

The Market's Unpredictability

While long-term value increase is a possibility, there are no guarantees in the rare coin market. Demand can shift, bringing about price fluctuations. Investors should look for coins with demonstrable historical interest and a solid base of collector demand to improve their chances of achieving gains.

Addressing Counterfeit Risks

One of the risks associated with rare coin investing is the presence of counterfeit or altered coins. These can be difficult for the inexperienced eye to identify. Purchasing from reputable dealers and relying on well-established third-party grading services like PCGS and NGC is recommended to diminish this risk.

The Hobby Aspect

Rare coin collecting offers an appealing intersection between hobby and investment. Knowledge reigns supreme in this field, and caution is a crucial companion. Through study, mentorship, and prudent purchasing, enthusiasts can enjoy the historical and artistic dimensions of coin collecting while eyeing potential financial benefits.

By embracing these strategies and building upon a foundation of knowledge and understanding, investors can engage with the rare coin market more confidently and effectively. Rare coins not only deliver the thrill of owning a piece of history but also represent a potential asset to any well-rounded investment portfolio. As with any investment, remaining informed, cautious, and passionate about numismatics is key to navigating this unique and captivating journey.

Sources:- Investopedia- Finest Known- Numismatic Guaranty Co.- American Numismatic Association

In summary, rare coins provide a compelling blend of historical intrigue and financial opportunity. Stratifying your investment approach by incorporating educational resources, expert advice, and an understanding of market dynamics will help mitigate risks. The exciting pursuit of numismatics is more than just an investment strategy; it's a gateway to a deeper appreciation of history, art, and the enduring allure of rare coins. Whether you engage in coin collecting for pleasure, profit, or both, a well-informed and thoughtful approach is pivotal to success in this fascinating niche market.

Information for this article was gathered from the following source.