Coin collecting, a hobby with centuries-old roots, offers a unique blend of historical appreciation and potential financial reward. Whether you possess an inherited heirloom or harbor aspirations to curate your own numismatic treasure, understanding coin values and the nuances of coin collecting is essential.

Coin collecting, a hobby with centuries-old roots, offers a unique blend of historical appreciation and potential financial reward. Whether you possess an inherited heirloom or harbor aspirations to curate your own numismatic treasure, understanding coin values and the nuances of coin collecting is essential.

Understanding Coin Types

The numismatic universe is rich and varied, encompassing ancient relics, contemporary currencies, and everything in between. Collectors might zero in on a particular era, like Roman coins, or perhaps they are enthralled by thematic collections, such as wildlife depicted on world mintage. Choices are as diverse as the collectors themselves and are often dictated by personal interests, along with investment ambitions.

The Valuation Journey

Central to coin collecting is the process of valuation—an assessment that can turn an ordinary piece of metal into a coveted gem. Rarity, condition, and provenance are pivotal factors influencing a coin's price tag. Keen collectors stay abreast of market shifts and trends to make savvy buying and selling choices.

Deciphering Coin Grades

Coin grading systems provide a framework for evaluating condition—a critical determinant of value. This established scale ranges from worn pieces with little monetary worth to pristine specimens boasting perfect mint condition. Mastery of this grading system allows collectors to appraise coins with precision and confidence.

Rarity and Its Allure

Rarity casts a powerful spell in the coin collecting world. Low mintage figures, pivotal historical connections, or distinctive design elements can transform a simple coin into an exceedingly rare treasure. Prior to acquisition, a thorough investigation into a coin’s rarity can be the difference between a wise investment and an overpriced purchase.

Historical Significance: The Story Behind the Coin

Coins with historical weight often attract higher values, prized for the stories they encapsulate and the epochs they represent. They forge a palpable link to bygone days, making them not only valuable assets but also bearers of the past.

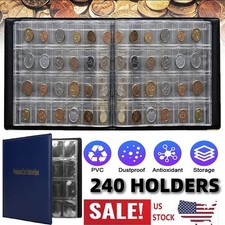

Coin Condition and Preservation

A coin's state is a telling indicator of its worth. Preserved with meticulous care, housed in purpose-built holders, coins can withstand the test of time and retain, if not appreciate, in value. Neglect, on the other hand, can diminish a coin's potential worth.

An Educated Collector

The resourceful collector is a perpetual student of the market. Conventions, coin forums, and specialist literature all serve as abundant resources to heighten knowledge. An informed collector is well-positioned to harness the hobby for both pleasure and financial advantage.

The Investment Perspective

A coin collection can serve as more than a hobby—it can also be a strategic investment vehicle. Rare coins, in particular, often emerge as a wise choice for portfolio diversification, exhibiting growth potential and resilience against market volatility.

The Rarity Factor in Investment

Rare coins have historically shown promise for considerable gains, appealing to those seeking assets outside of conventional financial instruments. Yet, these gains are typically realized over extended periods; patience is vital.

Diversification through Numismatics

A coin portfolio introduces diversification to an investor's asset mix, potentially mitigating risks and augmenting returns, particularly when blended with traditional stocks and bonds.

Understanding Market Dynamics

The market for rare coins can ebb and flow, paralleling other markets but with a tendency toward less pronounced swings. Factors influencing value include collector demand and the finite supply of true rarities.

Ensuring Authenticity

Counterfeit and tampered coins pose risks to unwary investors. Reputable grading services, such as PCGS and NGC, offer authentication that serves to protect and bolster investor confidence.

Numismatic Knowledge as Investment Capital

Education is an investor's safeguard and sword. Through mentorship, active engagement in the numismatic community, and relentless research, investors hone their acumen, vital for making informed strategic choices.

Portfolio Composition

An astute coin portfolio might encompass a mix of U.S. coins, precious metal bullion, and historic pieces like the coveted double eagle gold coin. Variety can help cushion against market wobbles and may lead to more robust returns.

A Word of Caution on Speculation

Coin flipping, or the rapid buying and selling of coins, can be a high-stakes gamble that often involves attempting to time and predict market movements—a task fraught with risk.

Beware of Bubbles

Every market bears the risk of speculative bubbles; the coin market is no different. A circumspect approach grounded in thorough research helps investors navigate this pitfall.

Final Thoughts on Rare Coin Investing

While not a complete substitute for conventional financial holdings, rare coins have carved out a niche as a solid long-term investment strategy, with an added layer of excitement for those drawn to its historical charm. Would-be investors must proceed with caution, arm themselves with knowledge, and keep their approach balanced and reasoned.

In your journey through the realms of coin collecting and investing, may your path be guided by wisdom, your decisions informed by knowledge, and your collection reflective of both the joy of collecting and the prudence of investing.

Information for this article was gathered from the following source.